If you or a loved one has been diagnosed with atrial fibrillation (AFib) not caused by a heart valve problem, and are seeking an alternative to long-term blood thinners like warfarin, you may have heard of the Watchman device. This innovative implant offers a way to reduce the risk of stroke by closing off the left atrial appendage (LAA)—a small pouch in the heart where most stroke-causing clots form.

While the clinical benefits are clear, a major question for many patients is: What does the Watchman device cost?

The answer is rarely a single, simple number. The total cost is a tapestry woven from the device itself, the hospital fees, the medical team’s expertise, and the complex landscape of health insurance. This guide will break down these components to give you a clearer understanding of the financial investment involved.

The Big Picture: What Are You Actually Paying For?

The “cost of the Watchman device” encompasses the entire procedure, not just the physical implant. The final bill typically includes:

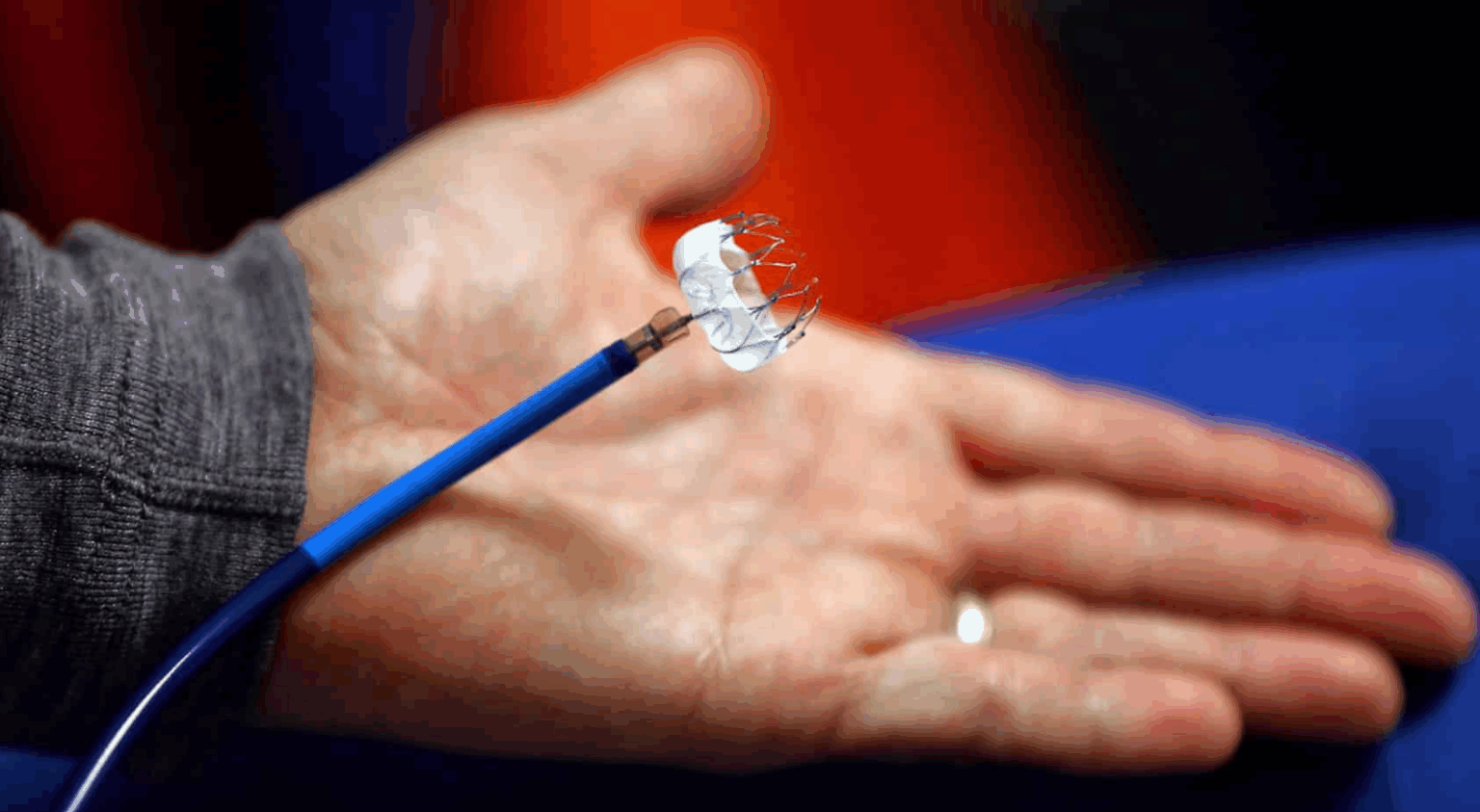

- The Device Itself: The Watchman implant and its delivery system are sophisticated, single-use medical technologies, representing a significant portion of the cost.

- Hospital/Facility Fees: This covers the use of the catheterization lab (cath lab), which is equipped with advanced imaging technology (like transesophageal echocardiogram – TEE), monitoring equipment, and sterile supplies.

- Physician Fees: You are paying for the expertise of the team performing the procedure, typically an interventional cardiologist and an electrophysiologist. Their fee covers the procedure itself, pre-operative consultations, and post-operative care.

- Anesthesia: The procedure requires anesthesia, so fees for the anesthesiologist or certified registered nurse anesthetist (CRNA) will be included.

- Pre- and Post-Procedure Care: This includes diagnostic tests (like CT scans or ultrasounds), blood work, medications, and follow-up appointments.

The Sticker Shock: Estimated Total Cost Range

Without insurance, the total cost for a Watchman implant procedure in the United States can be substantial, often ranging from $15,000 to $30,000 or more. The final amount depends heavily on the geographic location of the hospital, its specific pricing structure, and any complications that may arise.

This is why health insurance coverage is critical.

The Role of Health Insurance: Medicare and Private Payers

The most important factor in determining your out-of-pocket cost is your insurance coverage.

Medicare Coverage:

The Watchman device is covered by Medicare and many Medicare Advantage plans. Since its initial FDA approval and subsequent broad coverage decision, Medicare has recognized it as a reasonable and necessary alternative to long-term anticoagulation therapy for eligible patients. However, you will still be responsible for your plan’s cost-sharing, which typically includes:

- Deductibles: The amount you pay before your insurance starts to cover costs.

- Coinsurance: A percentage of the approved amount that you pay (e.g., 20% of the Medicare-approved cost).

- Copayments: A fixed amount for certain services.

For many Medicare patients, this can mean an out-of-pocket cost ranging from a few thousand dollars to potentially more, depending on their specific plan and supplemental insurance.

Private Insurance Coverage:

Most major private insurance companies now also cover the Watchman procedure, as its long-term benefits in reducing stroke risk and the costs associated with blood thinner management are well-documented. However, coverage policies can vary.

- Prior Authorization: Your doctor will almost certainly need to obtain pre-approval from your insurance company, demonstrating that you meet the specific clinical criteria for the device.

- In-Network vs. Out-of-Network: Your costs will be significantly lower if the hospital and all physicians involved are “in-network” with your insurance plan.

Crucial Step: Always contact your insurance provider before the procedure to understand your specific benefits, deductible status, and estimated out-of-pocket responsibility.

Weighing the Cost vs. The Long-Term Value

While the upfront cost of the Watchman procedure is high, it’s essential to view it as a long-term investment in your health and financial well-being.

- Reduction in Stroke Risk: Strokes can be devastating and incredibly expensive, often leading to long-term disability, rehabilitation, and ongoing care costs that far exceed the cost of the Watchman device.

- Freedom from Blood Thinners: For many patients, the ability to stop taking blood thinners like warfarin is a primary goal. This eliminates:

- The monthly cost of the medication itself.

- The cost and inconvenience of regular blood monitoring (INR tests).

- The dietary restrictions and potential for dangerous drug interactions.

- The risk and cost of treating major bleeding events, which are a significant risk of long-term anticoagulant use.

When viewed through this lens, the Watchman device can be a cost-effective solution over time, both for the healthcare system and for the patient’s quality of life.

Key Takeaways and Action Steps

- The “Cost” is a Bundle: Understand that the price tag includes the device, hospital stay, and professional fees.

- Insurance is Key: The procedure is widely covered by Medicare and most private insurers, but you will have out-of-pocket costs.

- Verify and Understand Your Coverage: The most critical step you can take is to work with your cardiologist’s office and your insurance company to get a detailed breakdown of what is covered and what your financial responsibility will be.

- Consider the Long-Term Value: Factor in the potential savings from stopping blood thinners and, most importantly, the invaluable benefit of reducing your lifelong risk of a debilitating stroke.

Navigating the cost of a major medical procedure can be daunting, but being an informed patient is your greatest asset. Have open conversations with your healthcare provider and your insurance company to make a decision that is right for both your health and your finances.